Renewable energy is our future, and it is growing at an unprecedented pace today.

Investing in renewable energy stocks is not just for environmental enthusiasts or financial experts; it is accessible to everyone — yes, including you!

This industry is not a passing trend but a thriving sector backed by political shifts, technological advances, and increasing consumer demand. Best of all, you don’t need a huge capital to start. Simple and well-thought steps can lead you to good profits.

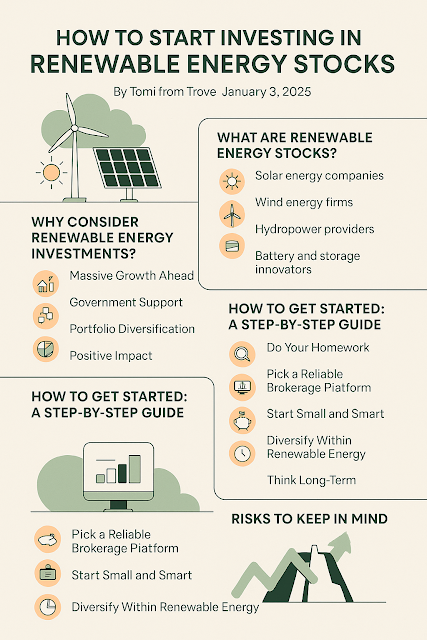

What Are Renewable Energy Stocks?

Renewable energy stocks represent companies that produce, distribute, or support clean energy technologies — such as solar panel manufacturers, wind turbine developers, or companies that provide battery storage solutions.

When you invest in these stocks, you are betting on a cleaner energy future that is already being built.

Examples of Renewable Energy Stocks:

- Solar Energy: Companies like First Solar and Sunrun specializing in manufacturing and installing solar panels.

- Wind Energy: Companies such as Vestas Wind Systems and Siemens Gamesa designing and manufacturing wind turbines.

- Hydropower: Companies like Brookfield Renewable Partners generating electricity from water sources.

- Battery Storage: Companies such as Tesla and Albemarle developing systems to store energy for renewable grids.

Why Invest in Renewable Energy Stocks?

The world is rapidly moving towards cleaner and more sustainable energy solutions. This is not just a fad but a global movement. By investing in renewable energy stocks, you position yourself in a fast-growing sector.

Solar, wind, and hydropower are unlimited energy sources that are becoming more cost-effective. The International Energy Agency expects renewables to account for nearly 90% of the expansion in global power capacity over the next decade.

Benefits of Investing in Renewable Energy Stocks

- High Growth Potential: The sector is expanding rapidly with significant profit opportunities.

- Diversification: Balances your investment portfolio by adding exposure to an innovative industry.

- Social Impact: Invest in alignment with global sustainability goals.

- Government Support: Policies and incentives encourage and back clean energy companies.

How to Start Investing in Renewable Energy Stocks?

1. Do Thorough Research

Before investing your money, it is essential to learn about the company you plan to invest in. Check their financial health, market position, and growth plans.

2. Choose a Reliable Brokerage Platform

To buy and sell stocks, you need a brokerage account. Choose a platform with low fees, easy-to-use interface, and a variety of investment options.

3. Start Small

Investing small amounts reduces risks, makes you more comfortable, and allows you to test the market without pressure.

4. Diversify Your Investments

Don’t put all your money in one company. Invest in different renewable sectors like solar, wind, and hydropower to spread risks.

5. Think Long-Term

The renewable energy sector is evolving continuously and requires patience and time to realize substantial profits.

Risks You Should Know

- Market Volatility: Stock prices can fluctuate quickly due to political or economic changes.

- Regulatory Risks: Government policies can impact company performance.

- Competition: Increasing companies in the sector may raise market challenges.

Conclusion

The renewable energy sector presents a smart investment opportunity combining profit potential with positive social impact. Despite some risks, the expected growth and government backing make it a worthy consideration.